The average UK house price increased by nearly £900 month on month in April, despite some homebuyers facing a stamp duty cliff edge, according to an index.

Halifax recorded a 0.3% month-on-month price rise in April, following a 0.5% monthly fall in March.

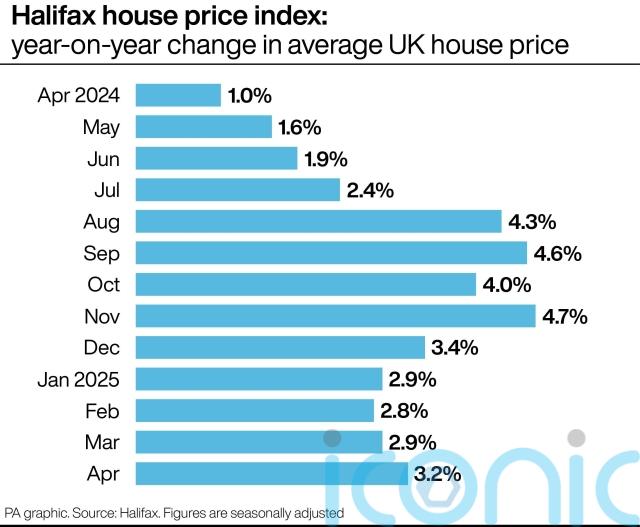

The annual house price growth rate ticked up to 3.2% in April, from 2.9% in March, Halifax said.

The average property price in April was £297,781, up from £296,899 in March.

Amanda Bryden, head of mortgages, Halifax, said: “UK house prices rose by 0.3% in March, an increase of just under £900.

“We know the stamp duty changes prompted a surge in transactions in the early part of this year, as buyers rushed to beat the tax-rise deadline.

“However, this didn’t lead to a significant increase in property prices, with the last six months characterised by a stability in prices rarely seen since the pandemic.”

Halifax’s figures are in contrast to Nationwide Building Society’s latest house price index, released last week.

Nationwide reported that house price growth had softened, with prices dipping by 0.6% month on month in April and price growth also slowing on an annual basis, at 3.4% in April, down from 3.9% in March.

Stamp duty “nil rate” bands have become less generous from April, with some buyers facing higher costs for moving home. Stamp duty applies in England and Northern Ireland.

Ms Bryden said “modest price growth” is expected this year, adding: “Overall, the market continues to show resilience, despite a subdued economic environment and risks from geopolitical developments.”

Looking across the UK, Halifax recorded strong house price growth in Northern Ireland, Wales and Scotland, with a more subdued picture in south-west England and London.

Nathan Emerson, chief executive of property professionals’ body Propertymark, said of the Halifax figures: “This is a sign of sustained confidence in the UK’s housing market following a recent stamp duty surge in home buying, and it should give those sellers hoping to take advantage of the traditionally busier spring and summer months motivation to move up the housing ladder.”

Iain McKenzie, chief executive of the Guild of Property Professionals, said: “We’re seeing mortgage rates continue their welcome descent, with sub-4% deals now reappearing, which is a clear boost for buyer affordability and confidence.”

Jonathan Handford, managing director at estate agent group Fine & Country, said: “The rebound in prices suggests the market may be finding its footing after a turbulent few months.”

Matt Thompson, head of sales at London-based estate agent Chestertons, said: “In April, some house hunters paused their search amid the Easter holidays, but sellers remained motivated which resulted in an uplift in the number of properties put up for sale.”

Tom Bill, head of UK residential research at Knight Frank, said: “Demand has increased as more mortgage rates drop below 4%, which will underpin prices while the momentum is maintained.

“Tariff turbulence has helped push interest rate expectations lower but buyers could be put off if it gets too bumpy.”

Jason Tebb, president of OnTheMarket, said: “With property prices remaining relatively steady, this suggests that affordability is having an impact on the amount buyers are willing and/or able to pay.”

Babek Ismayil, founder and chief executive at homebuying platform OneDome, said: “This increase masks ongoing affordability pressures and the longer-term hangover from the stamp duty changes in April.”

Tomer Aboody, director of specialist lender MT Finance, said: “The end of the stamp duty holiday in March saw a big push in transactions completing by the end of the month so that buyers could avoid the tax increase.

“We are now seeing the fallout, with transactions and mortgage approvals falling, although prices are holding steady.”

Here are average house prices and the annual increase, according to Halifax. The regional annual change figures are based on the most recent three months of approved mortgage transaction data:

East Midlands, £245,884, 3.0%

Eastern England, £335,619, 2.0%

London, £543,346, 1.3%

North East, £175,207, 2.1%

North West, £240,975, 4.1%

Northern Ireland, £208,220, 8.1%

Scotland, £214,011, 4.6%

South East, £391,830, 2.0%

South West, £304,451, 0.9%

Wales, £229,079, 4.7%

West Midlands, £261,098, 3.3%

Yorkshire and the Humber, £214,844, 3.8%

Subscribe or register today to discover more from DonegalLive.ie

Buy the e-paper of the Donegal Democrat, Donegal People's Press, Donegal Post and Inish Times here for instant access to Donegal's premier news titles.

Keep up with the latest news from Donegal with our daily newsletter featuring the most important stories of the day delivered to your inbox every evening at 5pm.